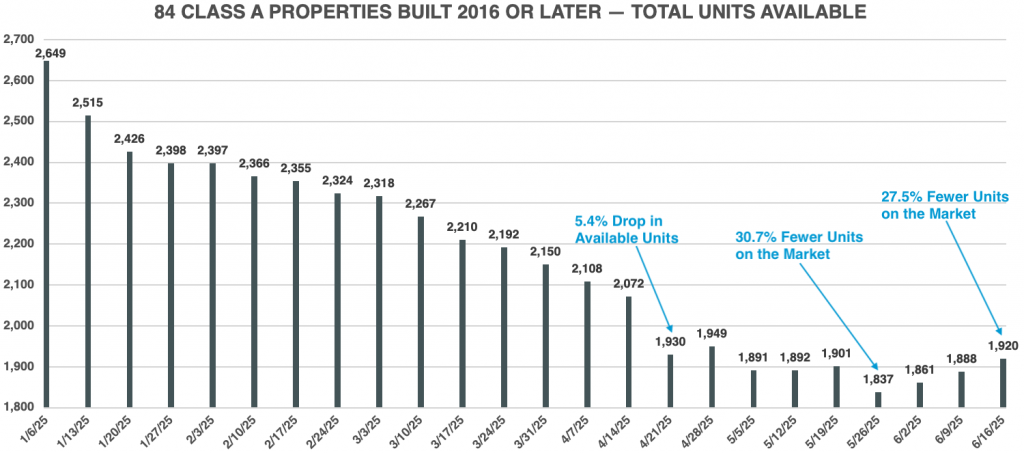

Luxury Living consistently tracks leasing data on larger assets in Downtown Chicago’s Class A Market built since 2016. This dataset currently includes 85 properties and 28,500 total units—and counting. These properties set the tone for the entire market.

October 2024 vs. October 2025

There have been several major supply-related storylines in the Chicago multifamily market throughout 2025.

- How is the lack of supply impacting rents?

- How is the lack of supply affecting available inventory, resident retention, and the absorption of different unit types?

- How will the unprecedented shortage of new Class A deliveries reshape leasing velocity, lease-up timelines, and the competitiveness of existing buildings?

The most consistent theme has been supply and demand. Demand has not waned, but supply is at an all-time low.

Let’s first take a look at how the lack of supply is impacting rents.

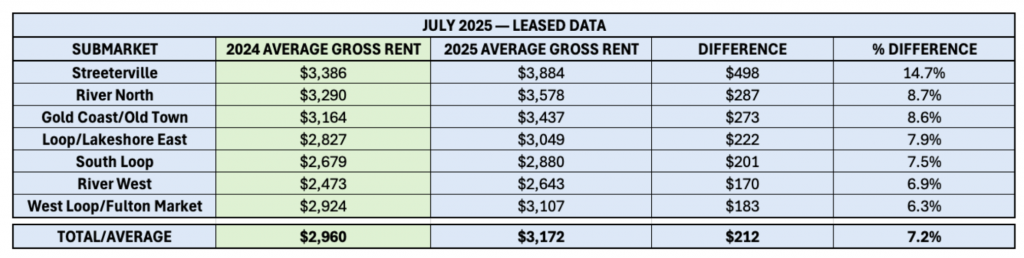

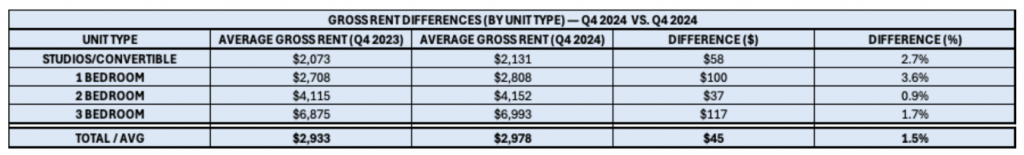

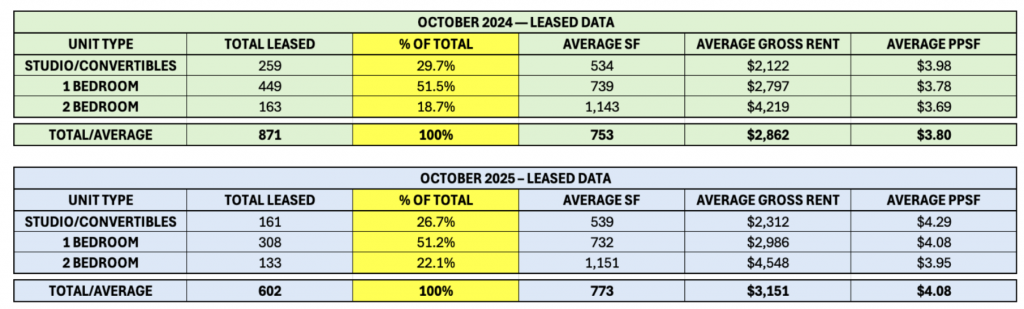

The tables below show YoY data for October 2024 and October 2025 for the most common unit types: Studios through 2 bedrooms, which historically represent more than 97% of units leased.

Average rent is up 10.1% ($289 per unit). This is the highest rent increase we have seen in a single month.

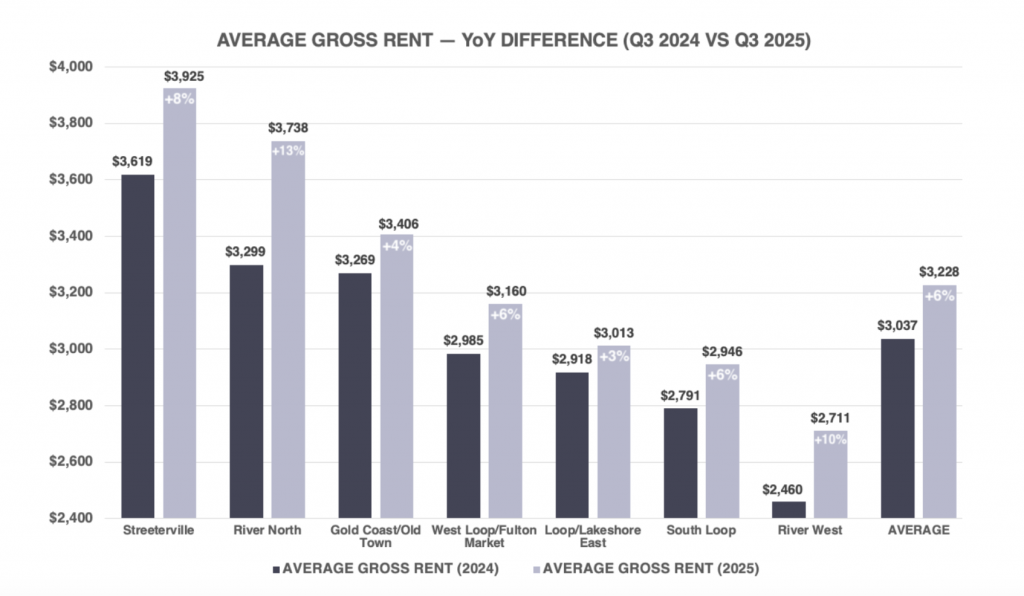

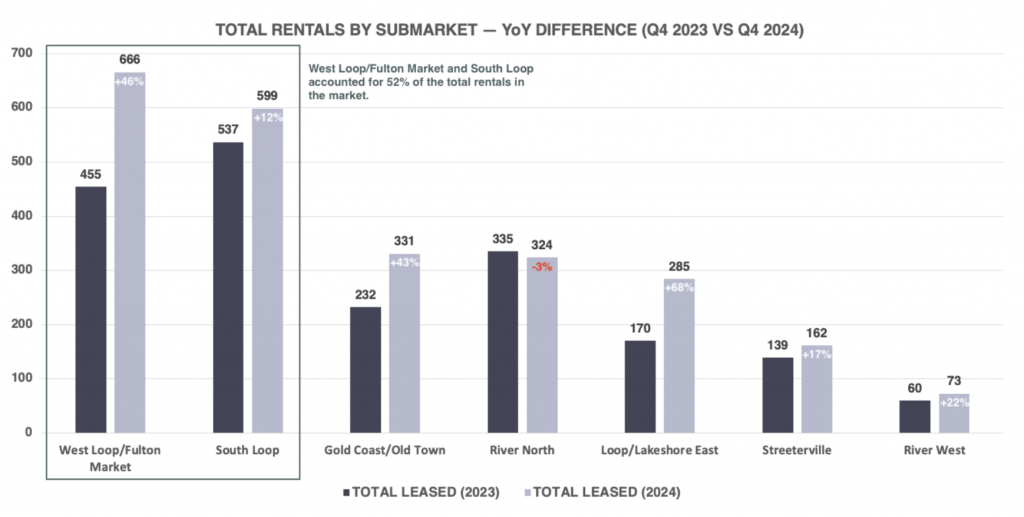

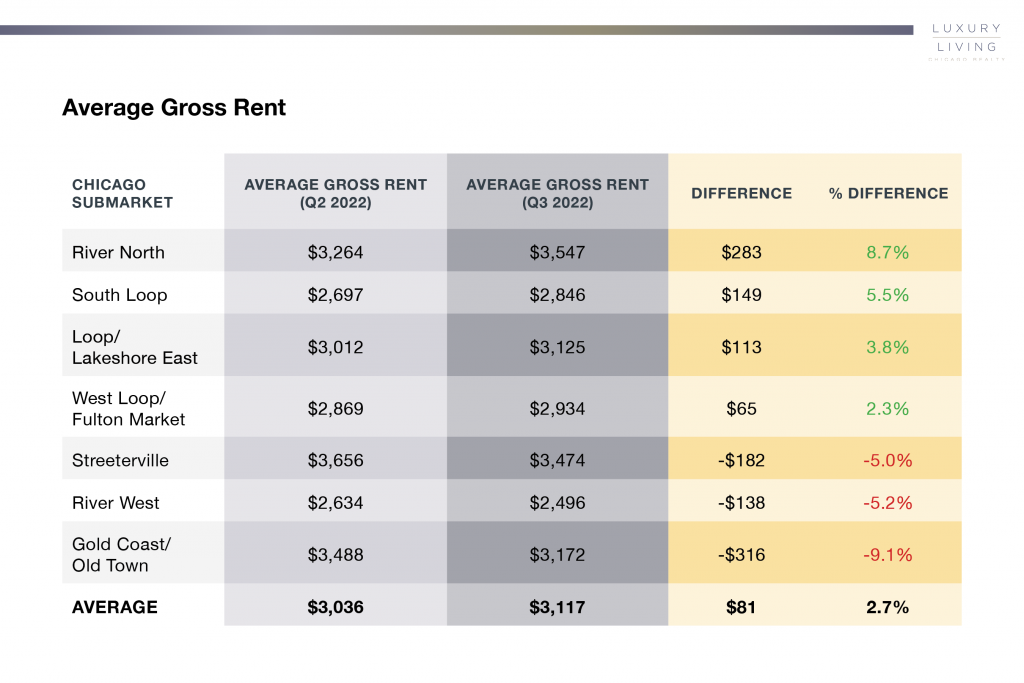

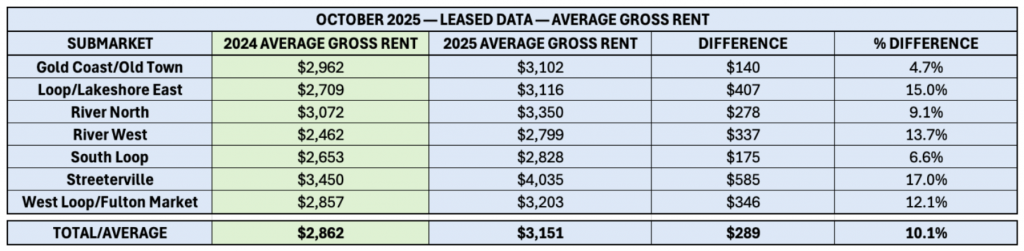

Average Gross Rent — By Submarket — Studios through 2 Bedrooms

- Average gross rent increased 10.1% YoY, rising by $289 across all downtown Class A submarkets.

- Streeterville led all submarkets with a 17.0% YoY increase, driven by a higher share of larger unit types compared to 2024.

- Loop/Lakeshore East posted a 15.0% increase, the second-highest YoY gain, reflecting continued rent growth in the most rent-suppressed submarket in Q4 2024.

- River West saw a 13.7% jump, further exemplifying the impact from concession-laden West Loop/Fulton Market in Q4 2024.

- West Loop/Fulton Market increased 12.1%, while increasing 7.9% in average SF.

- River North increased 9.1%, a meaningful gain that aligns with the submarket’s steady 1 bedroom and 2 bedroom absorption, along with a decrease in efficiency rentals compared to 2024.

- Perhaps the most impressive, the South Loop achieved a 6.6% increase, while having near-equal average SF compared to 2024.

- Gold Coast/Old Town recorded the lowest increase at 4.7%, partially due to a 33% decrease in efficiency units leased in 2025 compared to 2024, resulting in a 5.7% increase in gross rent for that unit type.

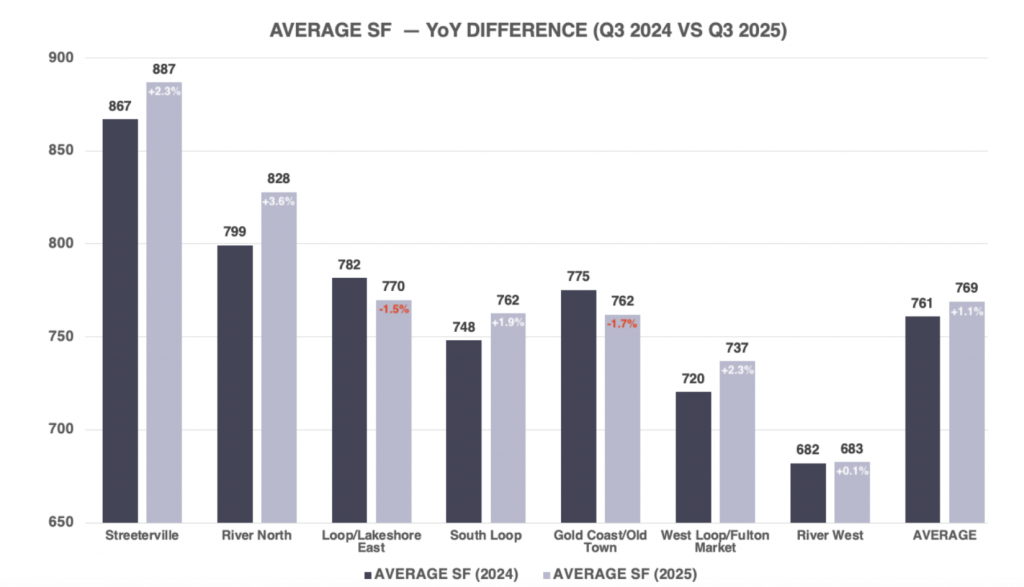

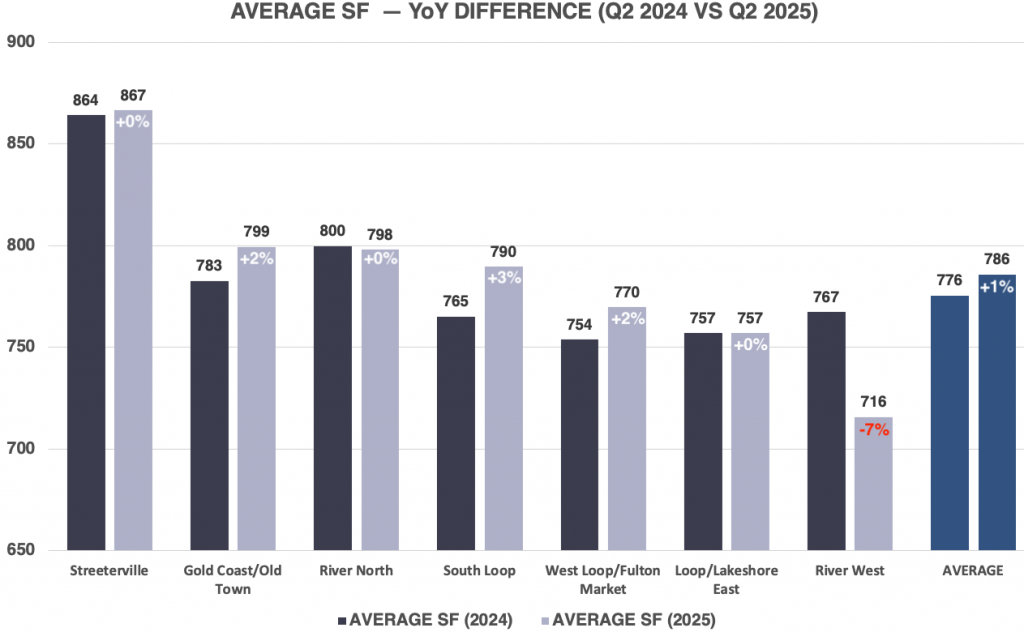

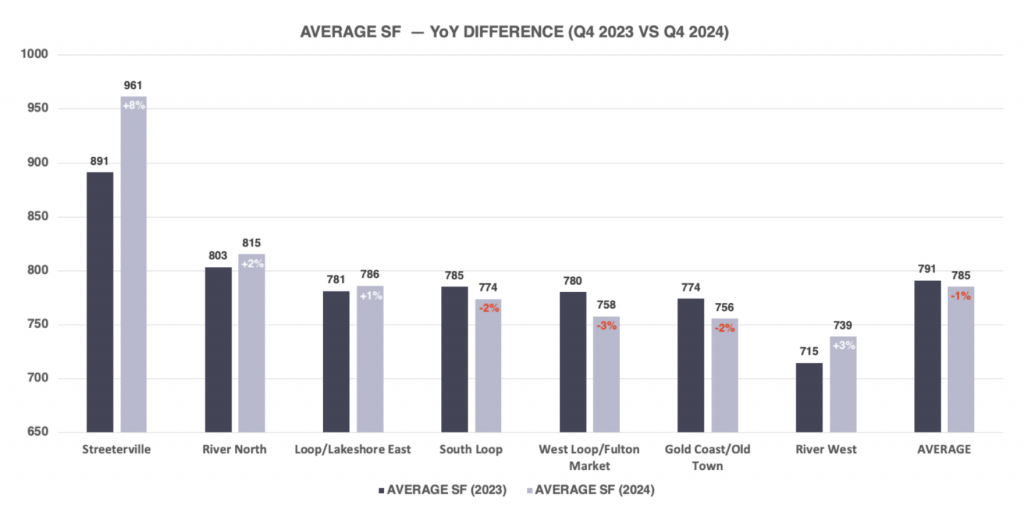

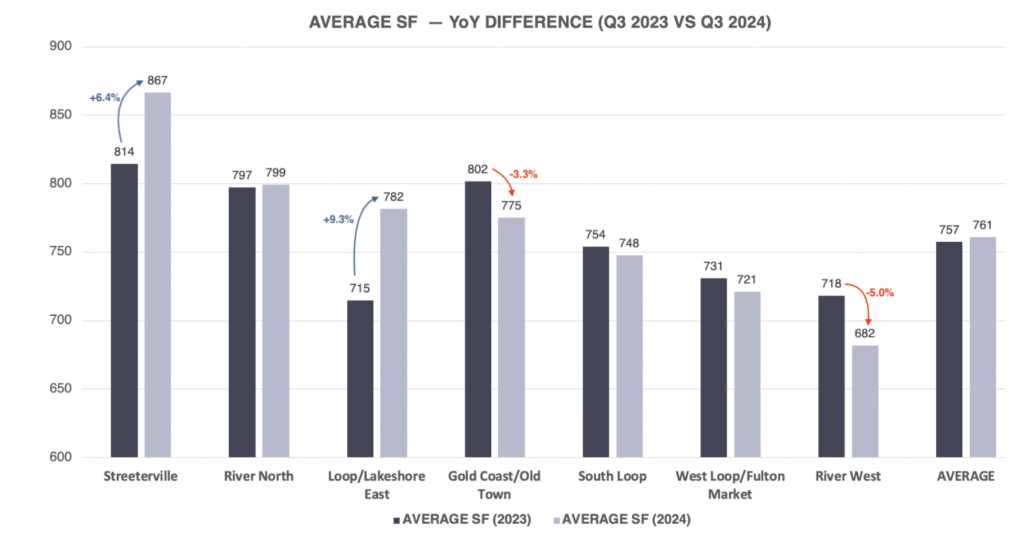

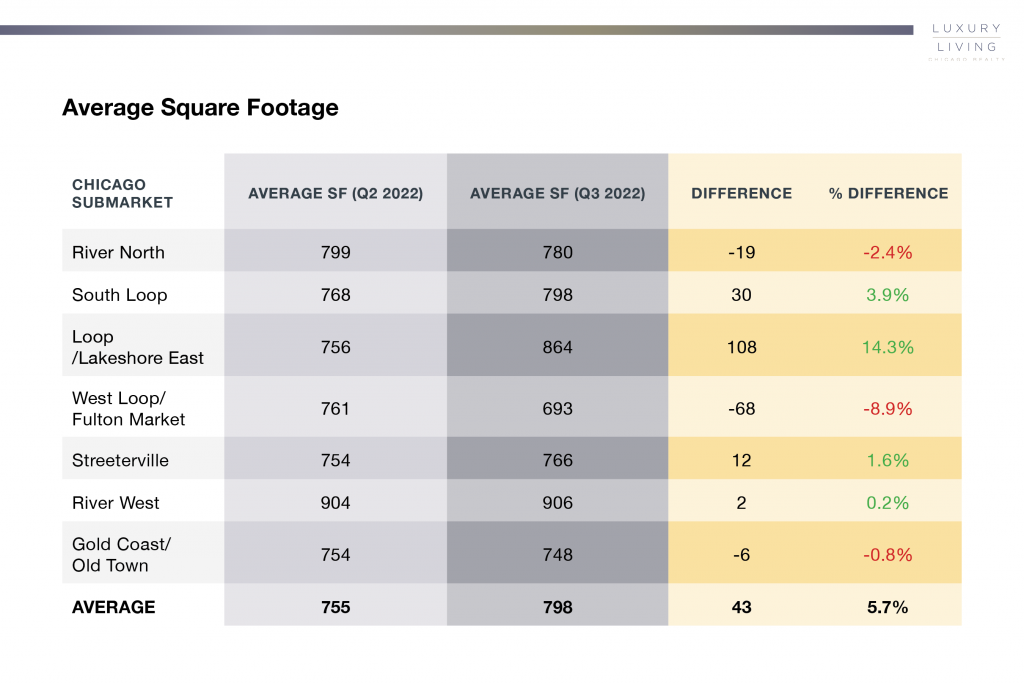

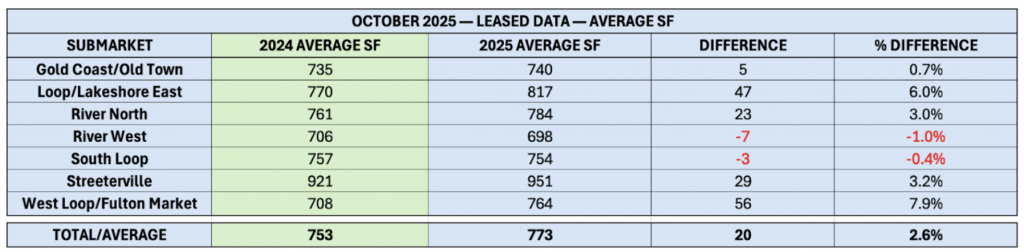

Average SF — By Submarket — Studios through 2 Bedrooms

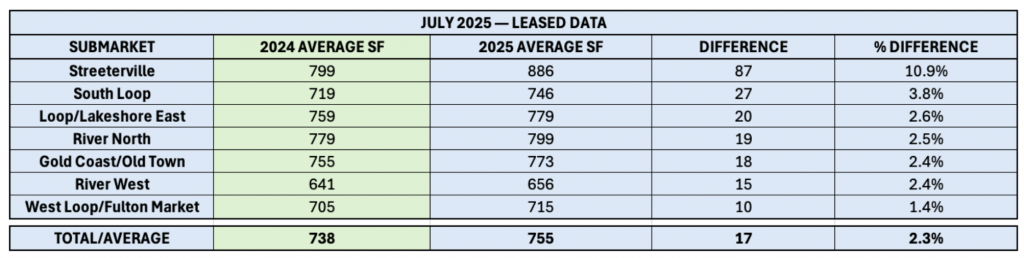

YoY square footage up 2.6%, rising from 753 SF to 773 SF, showing a slightly higher share of unit types larger than 1 bedrooms leasing in submarkets like West Loop/Fulton Market, Loop/Lakeshore East, Streeterville, and River North.

A 2.6% increase in average unit size has a noticeable impact on average gross rents. Smaller unit type absorption declined significantly year-over-year: studios and convertibles were down 38%, and 1 beds were down 31%, while 2 bedrooms declined only 18%. With fewer small units and a relatively stable share of 2 bedrooms, the overall unit mix shifts toward larger-unit absorption (2 Bedroom+). This shift naturally elevates average gross rents, even before factoring in rent growth.

- West Loop/Fulton Market had the most significant increase of 56 SF (+7.9%), which is due to a 61% decrease in studio/convertible rentals, dropping from 69 in 2024 to 27 in 2025.

- Loop/Lakeshore East had the second-highest jump of 47 SF (+6.0%), which is also due to a significant decline (-68%) in studio/convertible rentals in October.

- Streeterville grew 29 SF (+3.2%), maintaining its status as the submarket with the largest average units.

- River North increased 23 SF (+3.0%), assisted by a 4.7% increase in 2 bedroom SF compared to 2024.

- Gold Coast/Old Town increased 5 SF (+0.7%), showing minimal variance YoY, but plenty of movement by unit type.

- River West decreased 7 SF (-1.0%), due to a 50% reduction in 2 bedroom absorption YoY.

Tracking unit mix is crucial for evaluating rent fluctuations in the market, as SF directly impacts gross rents.

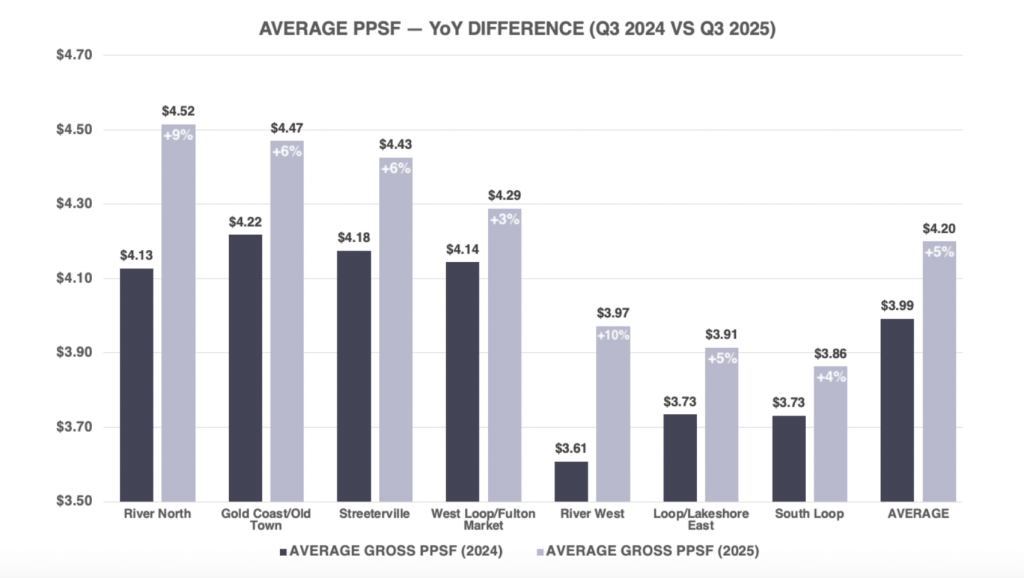

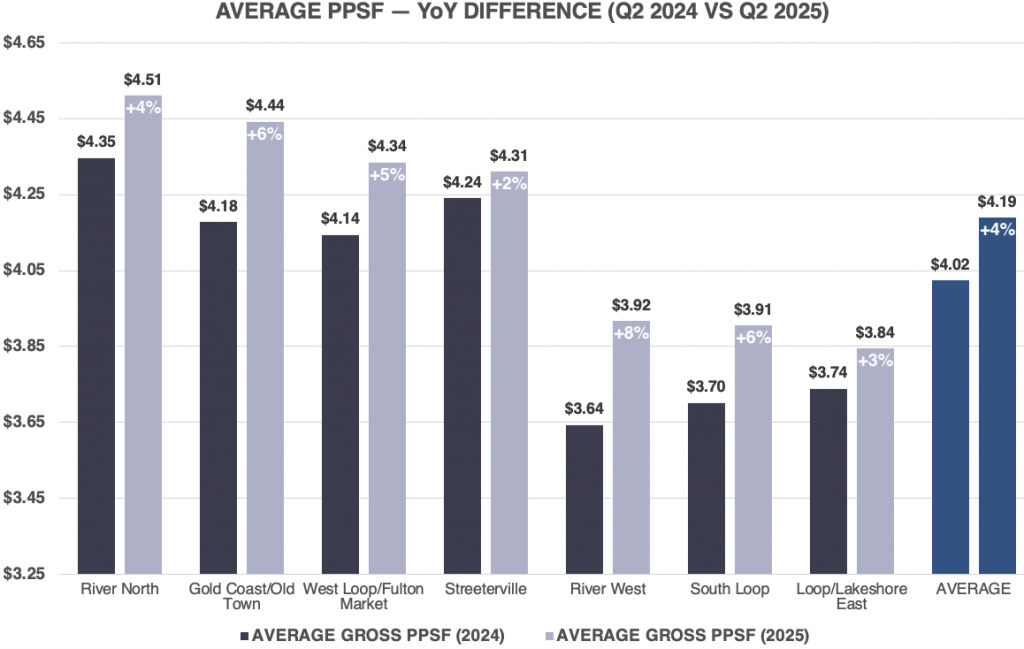

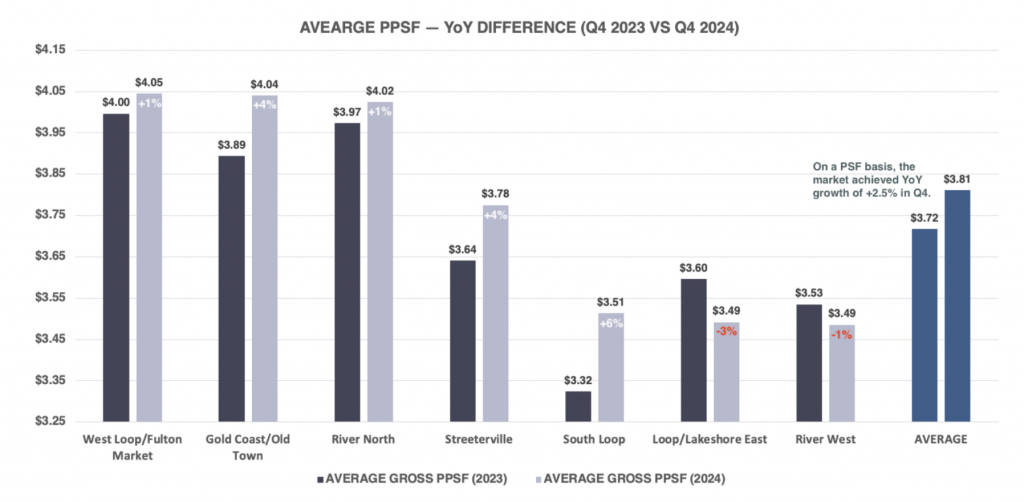

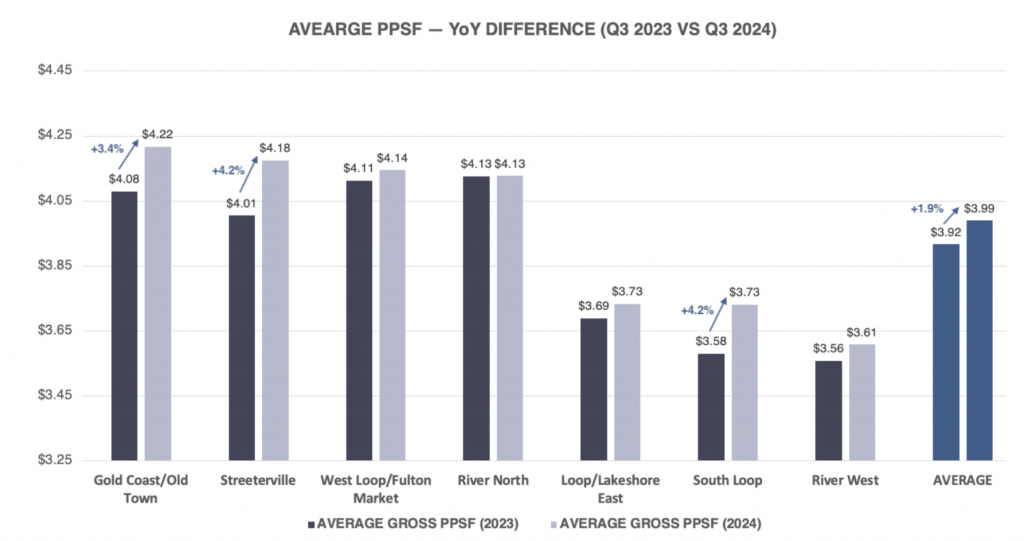

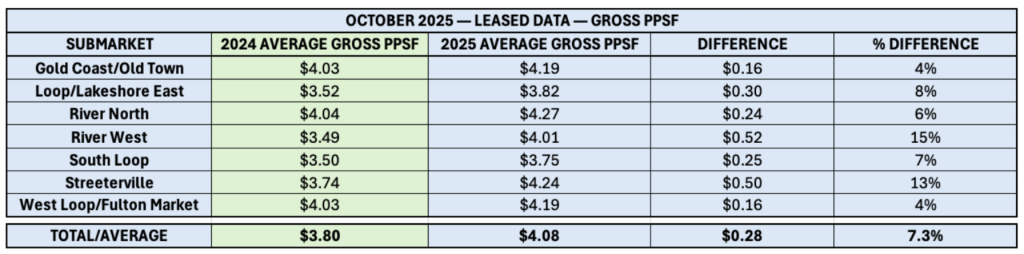

Average PPSF — By Submarket — Studios through 2 Bedrooms

October 2024 represented a unique moment in the market, when several lease-ups were pushing hard to reach stabilization. Instead of offering concessions, many properties chose to reduce rents outright, which sharply depressed achieved pricing heading into Q4.

To show how dramatic this dynamic was:

In 2024, average PPSF fell to $3.80 in October 2024, compared to $4.02 in August and $3.90 in September. Achieved PPSF in October 2024 was down 5.5% from August 2024 and down 2.6% from September 2024—not quite falling off a cliff, but certainly a steep and unusual drop.

This year’s 7.3% increase in PPSF is partially driven by limited supply, but it also reflects a “double bounce” effect as the market corrects back upward from last year’s artificially depressed pricing.

Operators across the city are seeing exceptionally strong renewal rates and trade-outs as a result, and this dynamic is expected to continue into early 2026.

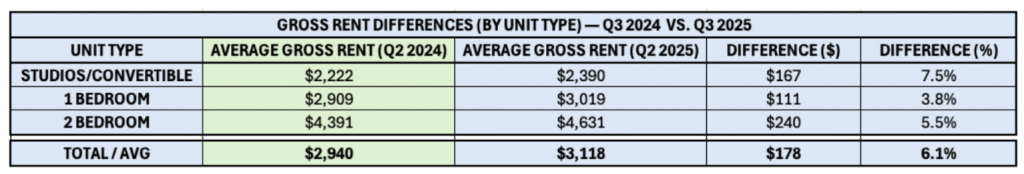

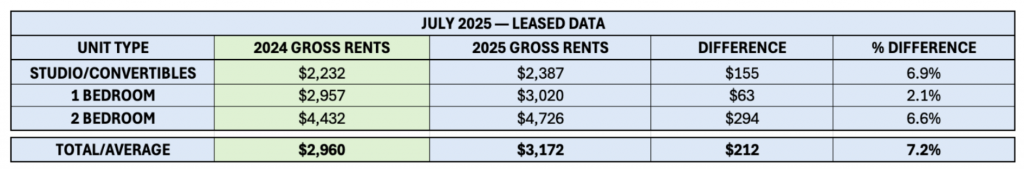

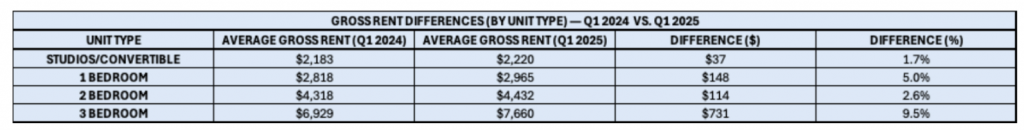

Unit-Type Analysis — Studios through 2 Bedrooms

Reviewing leased data down to the unit type will provide additional insight into YoY variances.

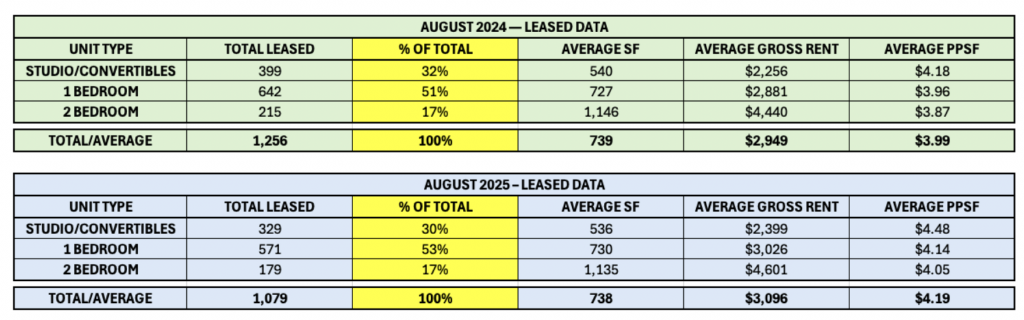

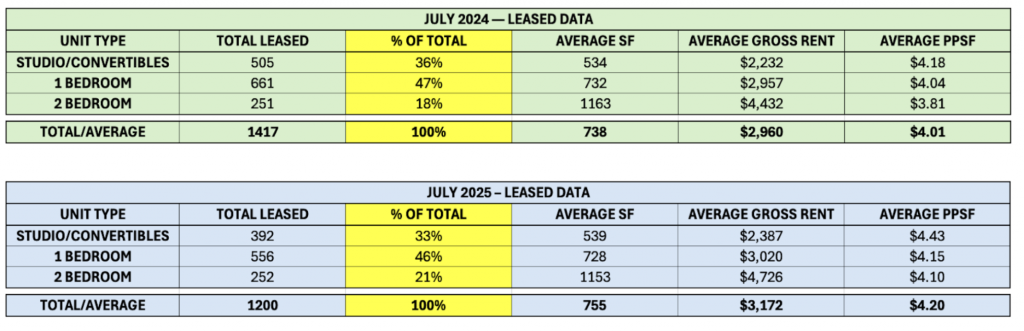

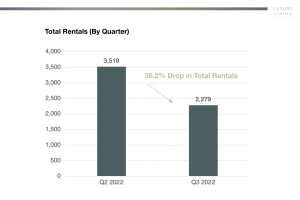

Monthly absorption has been rapidly declining since May, but October recorded the steepest year-over-year reduction at 31%, marking the sharpest contraction of the 2025 leasing season. While nearly one-third of the total rental volume from 2024 has vanished, the mix of units being absorbed also shifted.

As a share of total rentals, studios/convertibles declined 3.0%, while 2 bedrooms increased 3.4%, and 1 bedroom absorption remained essentially flat. Studios and convertibles saw the most significant drop, with 98 fewer rentals, representing a 38% YoY decline compared to October 2024.

Unit-Type YoY Rent Increases:

- Studios/Convertibles: +9.0% in gross rent / +7.8% in PPSF / +1.1% in SF

- 1 Bedrooms: +6.8% in gross rent / +7.8% in PPSF / -0.9% in SF

- 2 Bedrooms: +7.8% in gross rent / +7.0% in PPSF / +0.7% in SF

Despite the sharp differences in absorption, PPSF increases were relatively consistent, ranging from 7.0% to 7.8%. Gross rent increases showed more variation, from 6.8% to 9.0%, primarily driven by shifts in unit mix and the larger average square footage in the 2025 data set.

The combination of unit-type absorption patterns and a 2.6% increase in average square footage contributed to gross rent and PPSF growth that exceeded typical seasonal expectations. The underlying dynamic is clear: with fewer smaller units available, and a higher proportion of larger floor plans absorbing, both gross rent and PPSF naturally pushed higher.

Conclusion

October’s results reinforce what we’ve seen all year: demand is strong, but the market simply doesn’t have enough new supply to absorb it. With available Class A inventory down 36.5% since January, every metric in this report points back to the same underlying issue: renters are competing for fewer options.

Rents rose sharply across nearly every submarket, with average gross rent up 10.1% and PPSF up 7.3%. A shift toward leasing larger units also played a meaningful role, as average square footage increased 2.6% year-over-year.

Unit-type absorption helps explain the jump. Studio and convertible absorption dropped 38%, while 2 bedroom absorption held more steady, pushing the overall mix toward larger homes that command higher rents. PPSF growth was consistent across all unit types, landing between 7.0% and 7.8%.

This is also a “double bounce” year. October 2024 pricing was unusually depressed due to multiple lease-ups dropping rents to reach stabilization, creating an artificially low baseline. The 2025 recovery reflects both genuine rent growth and a correction back to normal pricing levels.

Looking forward, this dynamic should continue through early 2026. With so little new supply delivering, renewal strength and trade-outs will remain elevated.