Luxury Living consistently tracks leasing data on larger assets in Downtown Chicago’s Class A Market built since 2016. This dataset currently includes 84 properties and over 27,500 total units—and counting. These properties set the tone for the entire market.

The data we generally cover primarily includes leased units, which show what is actually happening in Chicago. Alternatively, relying on asking/advertised rents can lead to misleading and unattainable conclusions.

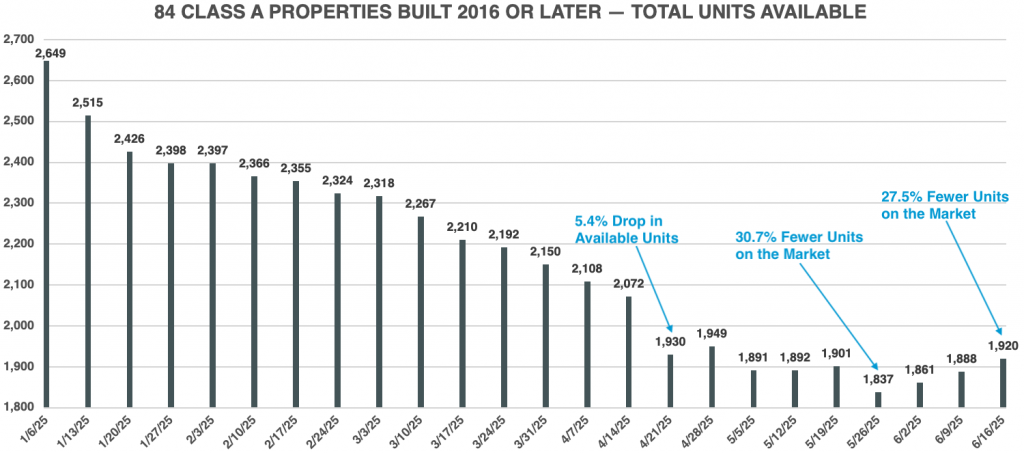

For this analysis, we are exploring availability trends in 2025, where available units on the market have plummeted since the beginning of the year.

We are also exploring the impact on achieved rents to illustrate the dramatic supply/demand imbalance playing out in downtown Chicago Class A multifamily. This dynamic is resulting in above-market rent increases.

We’ve long known that 2025 would mark the onset of significant supply constraints in the city, and while the impact was anticipated, the outcome was never fully certain.

The graph below shows the total number of available units within this set of 84 properties tracked throughout 2025. This number represents the number of apartments being advertised to potential renters.

At the start of 2025, availability among Class A properties built in 2016 or later totaled 2,649 units, representing 9.7% of the market’s total inventory. Over the following weeks, supply declined steadily, dropping by 1% to 3% per week through most of Q1. This trend culminated in a sharper decline the week of April 14, when inventory fell by 5.4% in a single week.

By the week of May 26th, less than three months into Chicago’s peak leasing season, availability had decreased by over 30%. From that point on, the market stabilized, with inventory fluctuating in the 1,830s to 1,920 unit-range through mid-June. This marked a sustained period of low availability when leasing activity historically peaks.

A key distinction in this cycle is the unusually low contribution of lease-up inventory to overall supply. Despite a few properties still stabilizing, very few units from these developments were actively listed, which is atypical for the downtown Chicago market during peak season. Historically, lease-up buildings provide a substantial share of new inventory, which is not the case this year, further underscoring how constrained the market is in 2025.

Another noteworthy trend is the timing of activity. While May and June are typically the strongest leasing months, April received 6.8% more rentals than May—a reversal of seasonal norms. This front-loaded demand further tightened the available unit pool and pushed asking/advertised rents upward.

The market is experiencing a significant imbalance between supply and demand. With inventory down over 700 units from January levels—a 27.5% decrease—rent pressure remains elevated. This reinforces the importance of timing lease expirations and pricing strategies to match market velocity.

The era of stabilized properties hovering around 95% leased is fading quickly—97% is now the new standard.

Using current market data, we analyzed the leased and exposure rates for 84 properties in this set. Exposure is calculated by dividing total available units (vacant and future availability) by total units in the property, while the leased percentage reflects only current vacancy.

Of the 1,920 available units, just 583 are vacant, resulting in a leased percentage of 97.9%—an exceptionally strong figure for this time of year.

The current exposure rate sits at 7.0%, with a recent low of 6.7% recorded the week of May 26, when available inventory was at its lowest.

There isn’t a single property in the city that wouldn’t be thrilled to be 97.9% leased with only 7.0% exposure during Chicago’s peak leasing season.

The two tables below show total units leased and gross rent achieved by month for March–May in both 2024 and 2025. Studios through 2 bedrooms—which represent over 97% of all leases.

With fewer lease-ups in the market, total rentals over the past 90 days declined by 326 units, a 7.4% drop in overall year-over-year volume.

The drop in rental volume—particularly in May—is directly tied to limited supply and aligns with the sharp decline in available units that began in mid-April.

The nearly 20% decrease in total rentals for May underscores just how critical new supply is to meet ongoing demand in the Chicago market. We anticipate this trend to continue for the remainder of 2025.

Limited supply contributed to stronger-than-usual rent growth.

From March through May 2025, average gross rents for studio to 2 bedroom units rose 3.8% year-over-year, rising from $3,002 to $3,121. Monthly increases ranged from 3.7% in May to a peak of 4.1% in April.

While rents typically begin climbing in May and peak in July, this year’s rent growth started much earlier due to supply constraints starting in Q1. As a result, April experienced the highest year-over-year gain of 4.1%, rising from $3,000 in 2024 to $3,127 in 2025.

Although May didn’t surpass April’s YoY growth rate, average rents in May were still 1.2% higher than April’s, reinforcing the strength of early-season demand.

As rents continue to rise at a historic pace, income qualification will become increasingly critical—especially as the average individual income needed to meet the industry standard of 3x monthly rent now exceeds $112,000, up more than $4,000 from 2024.

With inventory in Chicago expected to remain extremely limited for the next several years, asking rents will likely continue to climb. However, renter resistance will grow as affordability thresholds are tested. Value perception will play a pivotal role, as renters evaluate not just pricing, but the full living experience.

Renters will expect more value for their dollar—whether through elevated service, more resident events, or visible CapEx improvements. Complacency will no longer be tolerated, as five-star rents come with five-star expectations.

Each property will need to strike the right balance between pricing and its overall value proposition. In many ways, 2025 is shaping up to be a testing ground—an active laboratory for rent strategy—while 2026 and beyond may bring greater stability as market forces begin to normalize.

At Luxury Living, we not only provide data, but analyze the data to help inform developers and capital partners to make the best decisions on pricing strategy, unit mix, and amenity programming.

Luxury Living is here to help you in all aspects of multifamily development. From pre-development consulting to marketing and leasing, we are Chicago’s multifamily leasing expert.