Luxury Living consistently tracks leasing and availability data on larger multifamily assets in Downtown Chicago’s Class A Market built after 2016. This dataset currently includes 68 properties and just over 22,000 total units.

Tracking leased rentals instead of available units (asking rents) shows what is really happening in Chicago multifamily.

The following data covers leasing data from January 1, 2023 through May 31, 2023.

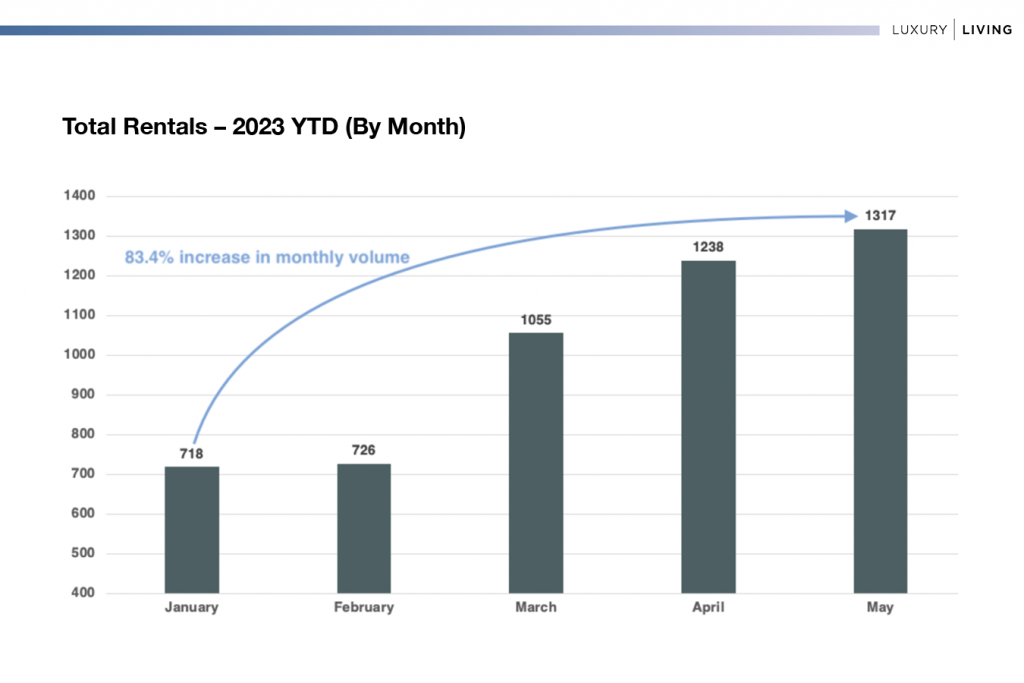

In the first five months of the year, 5,054 units have been leased in this segmented market. This chart below matches expected Chicago seasonality, where January and February are two of the lower-leasing volume months and the market starts to pick up in March.

There is an 83.4% increase in monthly volume when comparing January to May.

While January and February saw very similar leasing volume, it’s been a consistent climb each subsequent month this year.

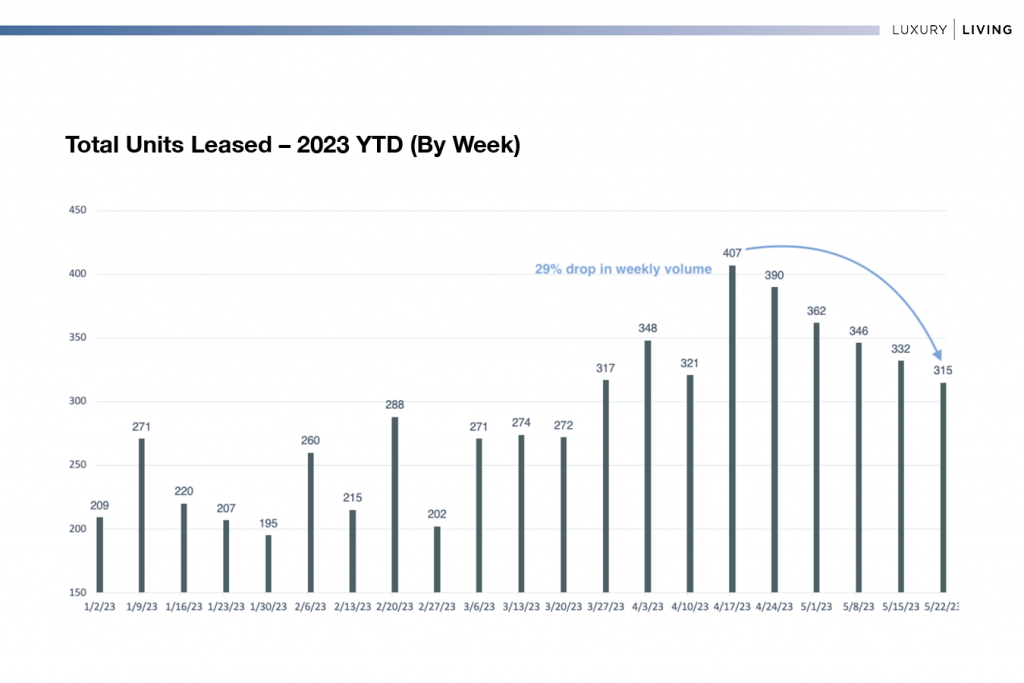

While month-over-month data shows consistent increases, week–over-week data illustrated in the chart below shows leasing volume likely peaked in mid-April.

Leasing volume is always about when renters are looking for an apartment, not when they are moving in. Renters in April and May are looking to move 45–75 days in advance. There is a big difference between peak leasing season and peak move-in season.

The answer: Not much.

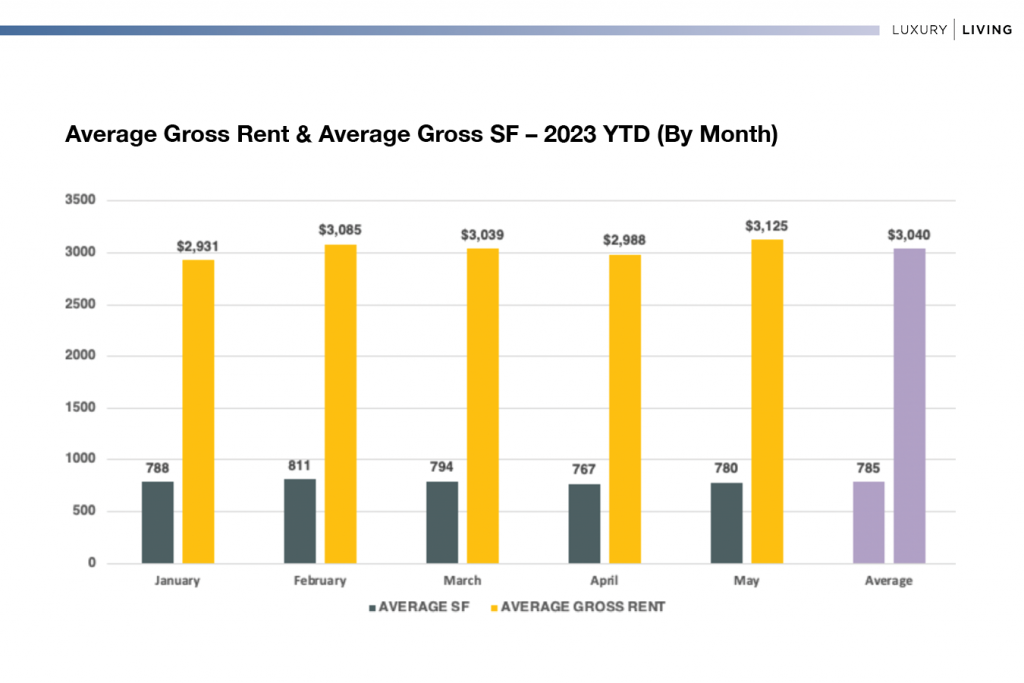

So far, the average gross rent in 2023 is $3,040.

The biggest gap in rent from the average is January (-$109), and the biggest gap from the peak ($3,125) compared to January is $194 (-6.6%). The overall trend is showing the gross rents this year have minimal variance, which indicates a stable market.

High occupancy and above-average retention is the most likely reason for this consistency. Often we see average square footage (SF) variance but each month has been relatively consistent.

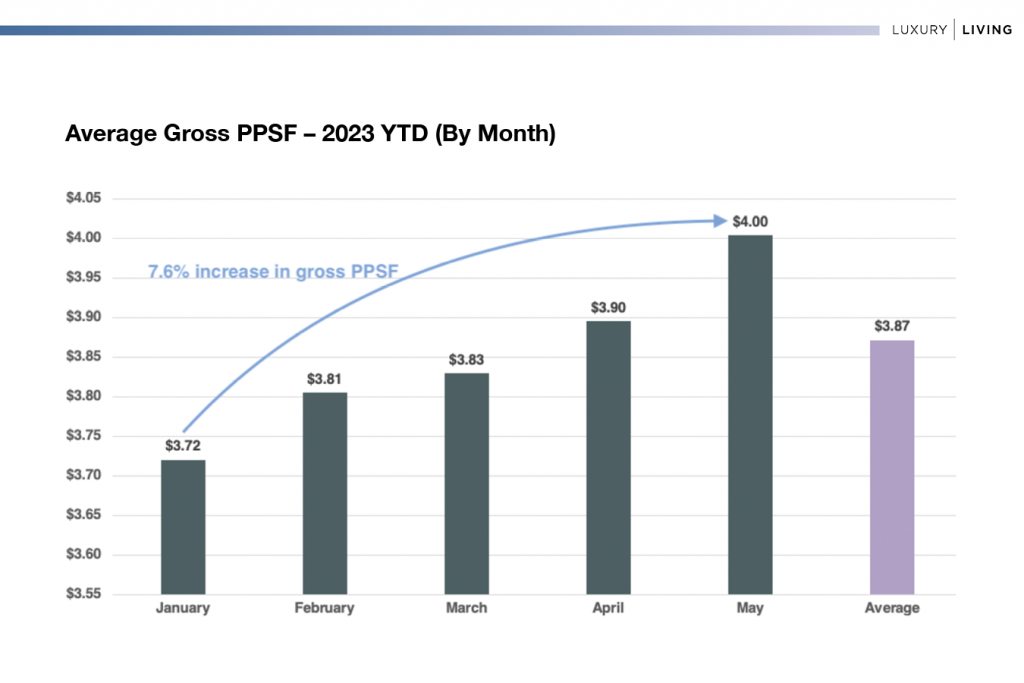

There is more to learn when viewing this by gross PPSF.

Despite the steady decline in weekly rentals, the gross rents and gross PPSF in May were extremely strong, achieving an average of $4.00 PSF with just over 1,300 rentals.

Not only did May surpass April by $137 in gross rent, but the average gross PPSF was also 2.8% higher, despite an average increase of 13 SF.

As occupancy remains high, gross rents will continue to increase slightly through the end of the summer. In 2022, we saw weekly volatility starting in June, but average gross rents didn’t really see a consistent dip until the end of September.

Rents are likely to remain in the $3,000+ range for the next 3-4 months, and gross PPSF is also likely to remain high as well ($4.00+ PSF).

The one data point to track is going to be weekly leasing volume. We’ll see some impressive rents, but it will be based on fewer and fewer rentals until the Bears play the Chiefs on September 24.

Pro Tip: July 4th Week is going to be weird. It falls on a Tuesday, so the volume that week is going to be low. No need to overreact, it will bounce back the following week.

Luxury Living is here to help you in all aspects of multifamily development. From pre-development consulting to marketing and leasing, we are Chicago’s multifamily leasing expert.